Written by Carl Witonsky, Managing Director

This article is the second in a multi-part series that will summarize various strategic options and their pros and cons. Typically, and again depending on the needs of the owner, it’s likely that two or three options should be examined when determining the best path forward. Owners should seek insights from their advisors to understand clearly what is available. These advisors are not only investment banks such as Falcon Capital but also an owner’s wealth, legal, and accounting advisors that play a key role in their thought processes. Finally, there are some things that need to be in place before even deciding on an option. I suggest that you read 5 Key Recommendations Before You Sell Your Business written by my colleagues Mark Gaeto and Conrad Olenik as a primer to this series. We begin our multi-part series with a discussion on Private Equity.

Private Equity Profile

If you run a later stage company with product/services that generate revenue in excess of $20 million dollars per year, earn above 15% in EBITDA, compete in a growth mark at least 10 times your revenue’s size, need equity growth capital or would like to cash out 40% to 100% of your investment, Private Equity (PE) should be explored.

There are approximately 800 PE firms in the U.S. with over $2.5 trillion dollars under management, including $820 billion dollars yet to be invested (“dry powder”). Most capital is raised from very wealthy individuals/trusts, corporate/government retirement funds, and university endowments. The average size of a PE fund is $470 million with an average size investment less than $100 million and, surprisingly, 40% of all investments below $25 million.

Business Plan

Before you contact a PE firm, you need to write a compelling business plan and presentation deck that describes the business, product/services, market size, organization (key members) and staffing, competition, 3-year to 5-year P&L forecast including cash flow, commentary on strategy to deploy the funds raised, and a brief resume of the key people. Ideally, you will want multiple PE firms competing for your business. Understand that the P&L forecast is a critical element of the PE overall valuation so you need to have a strong belief in making it happen as missing it will come back to bite you.

You want to learn as much about the PE firms as you can. For example: how large is their fund, do they have reserves for follow up investment rounds, how many board seats do they normally require (almost always a majority interest), who do they have in mind to represent those seats, what is their prior investment experience in your industry, how many board meetings per year (on site and telephonic, as travel and living is charged to you), and, what stock preferences will they enjoy and how long will this relationship likely last.

Pre-Money Valuation

For example, let’s assume you generated $25 million in revenue last year and earned $6 million in EBITDA and are projecting 30% growth every year for the next 4 years (the fourth-year for you company revenue reaching $71.40 million.) PE firms might assign a pre-money valuation of $60 to $70 million for your business. If you did the deal at $70 million you would receive $35 mil for selling 50% of the firm.

Post Deal Dilution

In order to grow the company rapidly additional executives will be needed and a stock option pool will be set up by the PE firm to help attract new blood and retain key people who did not participate in this transaction. 10% of the stock will be allocated to the option pool and it will be taken 50% from the PE firm and 50% from you. So, the new ownership table would be 45% you, 45 % PE firm and 10% option pool. You want to make sure you do not allocate the stock before the deal is struck, if you do so all 10% comes out of your pocket and nothing from the PE firm. In addition, the shares in the option pool will be priced at or around the price per share paid by the PE firm so many employees might not exercise the options until the company is sold.

In addition, many PE firms will do a onetime cash distribution from the company during the third year of the relationship to keep investors happy during what might be a five year wait for the company to be transacted. For example, the PE firm could cause the company to borrow $10 million dollars from a bank and distribute $5 million to the current stockholders of the company and five million to the PE investors (assuming none of the stock option holders have exercised their options). The bank loan might cost the company $600,000 dollars a year in interest which would be excluded from any EBITDA calculation.

In large corporate buyouts, PE firms might leverage their positions by taking out loans on the company’s books to pay the seller and thus use less of their own cash to do the deal. If the company does not meet expected performance these loans could put the company at great risk.

Exit Transaction

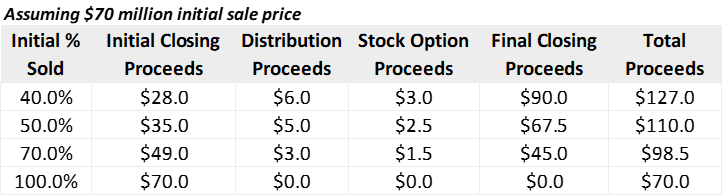

Let’s assume five years has passed and the PE firm finds a buyer for the firm agreeing to pay $160 million for the company. The $10 million-dollar loan would be paid off before any distribution thus reducing the proceeds to $150 million. The PE firm and the company stockholders would receive $67.5 million each and the remaining $15 million, less the stock option exercise price (let’s assume $5 million dollars) would go to employees. So, in total, the original company stockholders would have received: $35 million from the sale of 50% of the company, $5 million from the distribution, $2.5 million from the option holders stock conversion, and $67.5 million from the final sale if the company for a total of $110 million dollars. Had the owners sold 100% of the company up front they would have netted $70 million; by selling only half the company and working another 5 years they increased their payout by $40 million!

The below chart shows examples based on selling 40%, 50%, 75% and 100% of the company up front using $70 million as the initial sale valuation.

Seller Proceeds by % Sold Initially ($MM)