Written by Carl Witonsky, Managing Director

What is the best exit or strategic option as a business owner? The answer to this question differs depending on objectives, fact, and circumstances. When deciding the best way to optimize owner wealth or other goals when exiting a business, owners should understand and consider all their options.

This article will be the first in a multi-part series that will summarize various strategic options and their pros and cons. Typically, and again depending on the needs of the owner, it’s likely that two or three options should be examined when determining the best path forward. Owners should seek insights from their advisors to understand clearly what is available. These advisors are not only investment banks such as Falcon but also an owner’s wealth, legal, and accounting advisors that play a key role in their thought processes. Finally, there are some things that need to be in place before even deciding on an option. I suggest that you read 5 Key Recommendations Before You Sell Your Business written by my colleagues Mark Gaeto and Conrad Olenik as a primer to this series. We begin our multi-part series with a discussion on Venture Capital.

Venture Capital Profile

If you run an early stage company with product/services that generate revenue above $1 million dollars per year and need equity growth capital, Venture Capital (VC) should be explored. There are approximately 800 VC firms in the U.S. with an average fund size of $135 million that invest a total of $25 to $30 billion dollars a year. Typical investments range from $1 to $5 million, and if larger amounts are needed multiple VCs may team together to meet your needs.

Business Plan

Before you contact a VC, you need to write a compelling business plan and presentation deck that describes the business, product/services, market size, organization (key members) and staffing, competition, 3-year to 5-year P&L forecast including cash flow, commentary on strategy to deploy the funds raised, and a brief resume of the key people. Ideally, you will want multiple VCs competing for your business. Understand that the P&L forecast is a critical element of the VC overall valuation so you need to have a strong belief in making it happen as missing it will come back to bite you.

You want to learn as much about the VCs as you can. For example: how large is their fund, do they have reserves for follow up investment rounds, how many board seats do they normally require (normally minority interest), who do they have in mind to represent those seats, what is their prior investment experience in your industry, how many board meetings per year (on site and telephonic, as travel and living expenses are charged to you), what stock preferences will they enjoy (I will cover this in a later section), and how long will this relationship likely last.

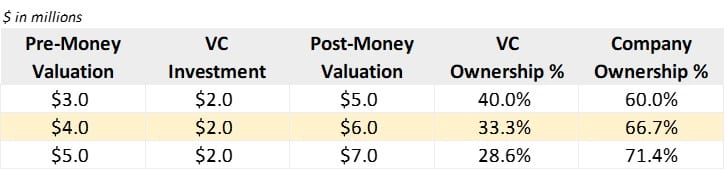

Pre-Money and Post Money Valuation

It may not happen in the first meeting, but you will have to consider how much stock ownership you are willing to give for the capital raised, so you need to do a pre-money valuation of the business. For this you look at the dollars invested to date including your own, family and friends, sweat equity (unpaid effort with little or no compensation), free rent, value for first to market, market size and likely penetration rate. Let’s look at a specific example. There is $1 million of capital invested to date, you and others have spent another $1 million in sweat equity, the market size is $250 million, last year’s revenue is $1 million, and you project revenue to grow to $20 million over the next 4 years with earnings before interest, taxes, depreciation, and amortization (EBITDA) of 20% or $4 million. In these circumstances, you could defend a pre-money valuation of $4 million.

If you raised $2 million in equity, the post-money valuation would be $6 million and you would own 2/3 of the outstanding stock (Common) and the VC would now own 1/3 of the stock (Preferred). Remember, the VC wants to invest the least amount of money to gain the highest return in the shortest time; you want the most money by giving up the least amount of stock for the time it takes to be cash flow positive and successful.

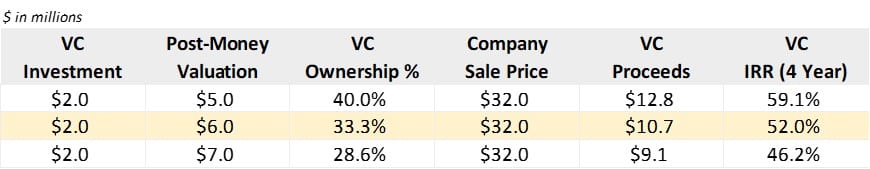

Venture Capital Expectation

So, let’s look at the deal from the VC point of view. If the company meets its 4-year revenue and EBITDA objectives of $20 million and $4 million respectfully and was transacted at a multiple of 8 times earnings (8x EBITDA), the sale price would be $32 million and their 1/3 share would net $10.7 million, a 5.1x return. The Internal Rate of Return (IRR), the primary measuring stick for VC, would be 52% a year, creating a very attractive return.

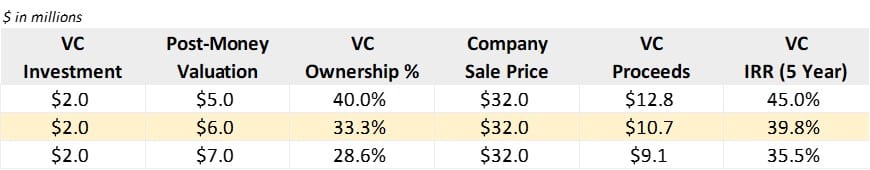

IRR is sometimes referred to as “economic rate of return” or “discounted cash flow rate of return” and is highly dependent on the overall length of the investment period. If the VC company sale took place in five years instead of four, the IRR would have dropped to 39.8%.

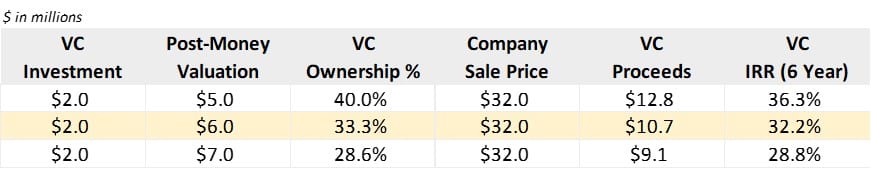

If the company sale happened after six years, the IRR would be even lower at 32.2%.

Term Sheet

Once both parties agree, the VC will often write a Letter of Intent (LOI or Term Sheet), a non-binding high-level statement of the deal (typically subject to Due Diligence and other closing conditions). Once you accept the Term Sheet you will be prohibited from shopping the deal for 30 to 60 days. Even though the VC holds a minority interest you will be subject to certain limits of what you can do unless you have their prior approval. For example, you cannot expand the stock option pool or grant stock options, you cannot grant executive raises or bonuses, you cannot purchase an asset over XXX dollars, you cannot spend over the approved budget, and you cannot sign long term leases. In addition, not all VC deals meet the original objectives so VCs will often require a sale preference that protects them if the company is sold below the original objective price.

Exit Transaction

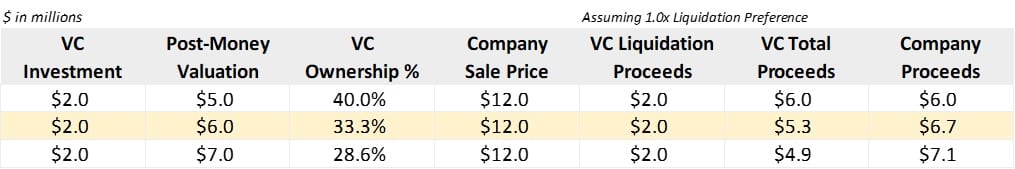

If we continue our earlier example assuming a $2 million VC investment, let’s look at what might happen in a downside scenario when coupled with liquidation preferences. If the company is sold after 4 years for $12 million and the VC has a 1x preference, then the $12 million sale price has $2 million taken off the top to repay the VC original investment. Then the remaining $10 million is split 2/3 for you and 1/3 to the VC. So, instead of you getting $8 million and the VC getting $4 million based on the simple ownership percentages, you will receive $6.7 million and the VC $5.3 million.

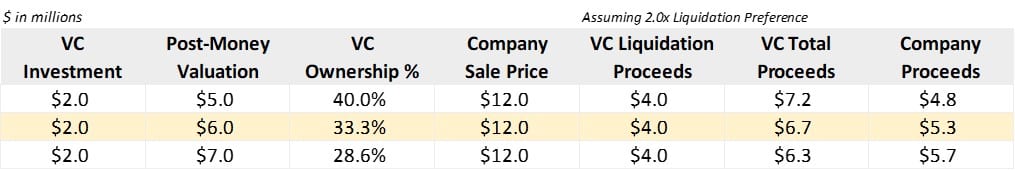

If the preference was 2x and the sale price was $12 million, $4 million would be distributed to the VC and the remaining $8 million would be split 2/3 to you and 1/3 to the VC. This would result in the VC receiving $6.7 million and you receiving $5.3 million. Said another way: the VC owned 33% of the equity but was paid 56% of the sale proceeds.

These preferences are baked into the VC term sheets to de-risk their investment in the form of downside protection. However, if an agreed upon sale price is reached or exceeded then the X preference should be eliminated.